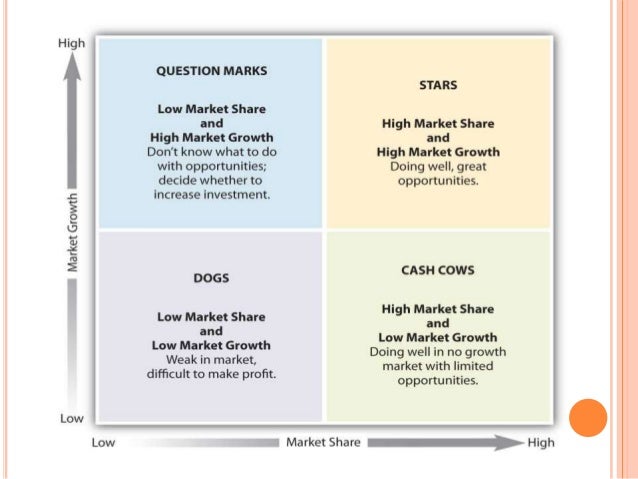

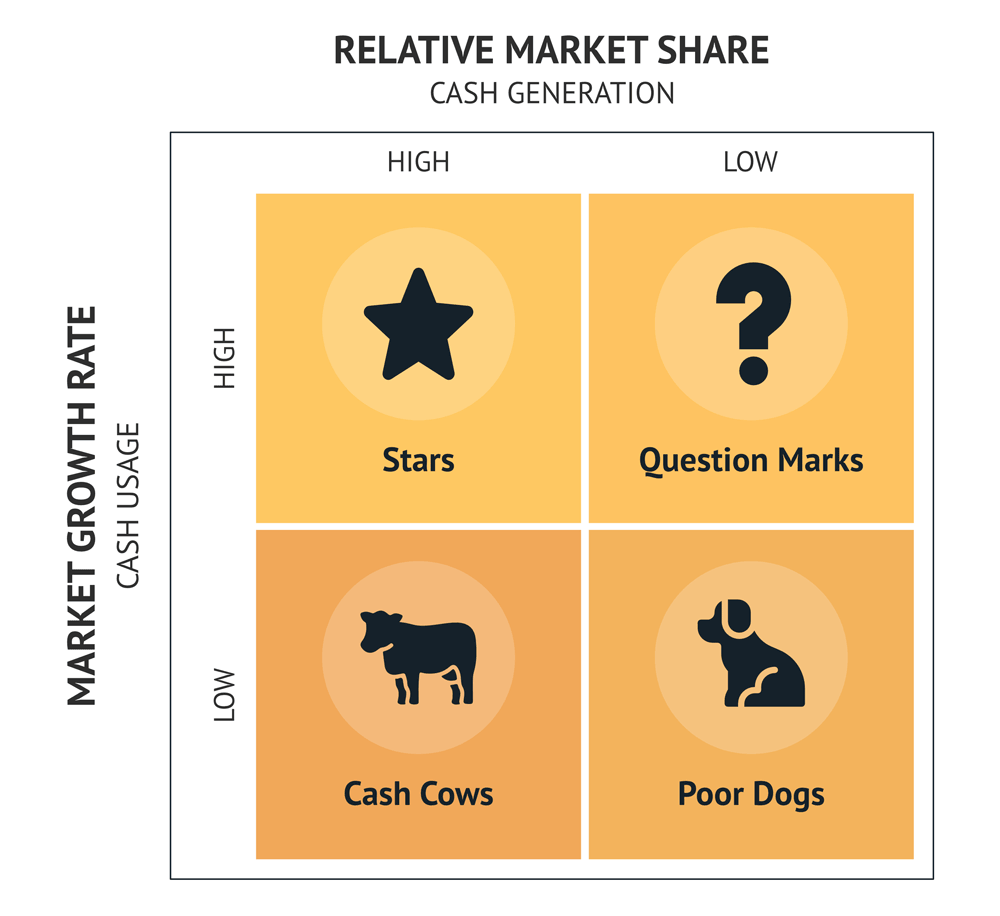

There are a number of dangers in assuming that a product is a 'cash cow'. Compliance with these strategic tenets has led to devastating results for some companies. cash cows) adopt holding or harvesting strategies rather than encouraging them to try to increase the total demand of the markets in which their products are selling. The strategic principles involved advocate that companies with large market shares in static or low-growth markets (i.e. (2) The matrix encourages companies to adopt holding strategies The new matrix makes the exercise much more a matter of qualitative judgement. The vertical axis now indicates the number of ways in which a unique advantage may be achieved over competitors, and the horizontal axis is a measure of the size advantage that may be created over competitors. The ideal progression is illustrated below: The cash that they then generate can be used to turn problem children into stars, and eventually cash cows.Stars tend to move vertically downwards as the market growth rate slows, to become cash cows.

The log scale is used so that the midpoint of the axis is 1.0, the point at which an organisation's market share is exactly equal to that of its largest competitor.

Relative market share is defined by the ratio of market share to the market of the largest competitor. The midpoint of the growth dimension is usually set at 10% annual growth rate markets growing in excess of 10% are considered to be high-growth markets and those growing at less are low-growth markets.

New markets may grow explosively while mature markets grow hardly at all. An organisation with such a product can attempt to appeal to a specialised market, delete the product or harvest profits by cutting back support services to a minimum.Īssessing the rate of market growth as high or low is difficult because it depends on the market.

0 kommentar(er)

0 kommentar(er)